SHINDE Stock Brokers provide the complete platform easy to trade Derivatives on Over-the-Counter online during trading hours using Trading Account. SHINDE Stock Brokers has a wide range of API network & web based process system.

OTC Derivatives

☰ Over-the-Counter DerivativesContract Obligation

✭ Option

Call or Put

Underlier

✺ Stock Futures

✺ Warant Futures

✺ Bond Futures

✺ Credit default Futures

✺ Interest Rate Cap & Floor

✺ Currency Futures

✺ Commodity Futures

✭ Forwards

Buy & Sell

Underlier

✺ Stock Futures

✺ Bond Futures

✺ Interest Rate Futures

✺ Credit Futures

✺ Currency Futures

✺ Commodity Futures

✭ Forwards

REPO

Underlier

✺ Stock Futures

✺ Bond Futures

✺ Interest Rate Futures

✺ Credit Futures

✺ Currency Fututes

✺ Commodity Futures

✭ Swaps

FRA

Underlier

✺ Stock

✺ Bond

✺ Zero Coupon

✺ Basis

✺ Interest Rate

✺ Deferred Rate

✺ Total Return

✺ Credit default

✺ Constant Maturity

✺ Currency

✺ Commodity

✺ Inflation

✺ Equity Risk

✺ Subordinated Risk

✺ Variance Risk

✺ Amortizing

✺ Accreting

✺ Quanto

✺ Range accrual

✺ Three-Zone Digital

Account

☰ Derivatives Trading Account✭ NRI Currency Derivatives Trading Account

✺ NRE Currency Derivatives Repatriable Trading Account

✻ Linked- NRE Account

✻ Linked- NRE PIS Account

✭ NRO Currency Derivatives Non-Repatriable Trading Account

✻ Linked- NRO Account

✭ OCI Currency Derivatives Trading Account

✺ NRE Currency Derivatives Repatriable Trading Account

✻ Linked- NRE Account

✻ Linked- NRE PIS Account

✭ NRO Currency Derivatives Non-Repatriable Trading Account

✻ Linked- NRO Account

✭ HNI Regular Derivatives Trading Account

✺ Linked- Saving Account

✺ Linked- HUF Saving Account

✭ S-HNI Regular Derivatives Trading Account

✺ Linked- Saving Account

✺ Linked- HUF Saving Account

✭ Retail Regular Derivatives Trading Account

✭ Linked- Saving Account

Open Trading Account

Open Trading Account:

✓ Free Trading Account Opening

✓ Free Equity Stock OTC Derivatives Research Call

✓ Free Equity Risk OTC Derivatives Research Call

✓ Free Warant OTC Derivatives Research Call

✓ Free Bond OTC Derivatives Research Call

✓ Free Basis OTC Derivatives Research Call

✓ Free Zero Coupon OTC Derivatives Research Call

✓ Free Interest Rate OTC Derivatives Research Call

✓ Free Interest Rate Cap & Floor OTC Derivatives Research Call

✓ Free Deferred Rate OTC Derivatives Research Call

✓ Free Total Return OTC Derivatives Research Call

✓ Free Credit default OTC Derivatives Research Call

✓ Free Constant Maturity OTC Derivatives Research Call

✓ Free Subordinated Risk OTC Derivatives Research Call

✓ Free Variance Risk OTC Derivatives Research Call

✓ Free Accreting OTC Derivatives Research Call

✓ Free Three-Zone Digital OTC Derivatives Research Call

✓ Free Currency OTC Derivatives Research Call

✓ Free Quanto OTC Derivatives Research Call

✓ Free Range Accrual OTC Derivatives Research Call

✓ Free Amortizing OTC Derivatives Research Call

✓ Free Commodity OTC Derivatives Research Call

✓ Free Inflation OTC Derivatives Research Call

✓ No Profit No Brokarage

✓ A Easy Derivatives Trading Platform

Benefit of our comprehensive training webinars and support as a TRADING ACCOUNT SERVICE

OTC Trader Facility

✭ Initial Margin✭ Span Margin

✭ Minimum Initial Margin

✭ Calendar Spread Margin

✭ Extreme Loss Margin

OTC Trader

✭ Hedger✭ Speculator

✭ Arbitrageur

OTC Trading

✭ Derivatives OTC Trading✺ Equity OTC Derivatives Trading

✺ Equity Risk OTC Derivatives Trading

✺ Warant OTC Derivatives Trading

✺ Bond OTC Derivatives Trading

✺ Basis OTC Derivatives Trading

✺ Zero Coupon OTC Derivatives Trading

✺ Interest Rate OTC Derivatives Trading

✺ Interest Rate Cap & Floor OTC Derivatives Trading

✺ Deferred Rate OTC Derivatives Trading

✺ Total Return OTC Derivatives Trading

✺ Credit default OTC Derivatives Trading

✺ Constant Maturity OTC Derivatives Trading

✺ Subordinated Risk OTC Derivatives Trading

✺ Variance Risk OTC Derivatives Trading

✺ Accreting OTC Derivatives Trading

✺ Three-Zone Digital OTC Derivatives Trading

✺ Currency OTC Derivatives Trading

✺ Quanto OTC Derivatives Trading

✺ Range Accrual OTC Derivatives Trading

✺ Amortizing OTC Derivatives Trading

✺ Commodity OTC Derivatives Trading

✺ Inflation OTC Derivatives Trading

Trading Platform

Trading Tool

Buy Trading ToolAlgo Trading

✭ Easy & Fast API✭ Free of Cost API

✭ Easy Programming

✭ Live Market Feed

✭ Live Market Feed

✭ Real Time Assistance

✭ Work on own algo strategies

✭ Create Algo Trading Platform

✭ Backtest & Optimization

✭ Paper Testing

Activate API TOTP

Algo Trading Platform

Call Option

✭ Call Option Strick Price✺ ITM Call Option Low Risk Immediate Profit

✻ In-The-Money (ITM) Call Option

☘ Intrinsic Value

☘ Time Value (Extrinsic Value)

☘ (Spot Price)>(Call Option Strick Price)

✺ ATM Call Option Moderate Risk Balance Immediate Profit

✻ At-The-Money (ATM) Call Option

☘ Time Value (Extrinsic Value)

☘ Spot Price≅Call Option Strick Price

✺ OTM Call Option High Risk Profit on Volatility & Strategy

✻ Out-of-The-Money (OTM) Call Option

☘ Time Value (Extrinsic Value)

☘ (Spot Price)<(Call Option Strick Price)

Put Option

✭ Put Option Strick Price✺ ITM Put Option Low Risk Immediate Profit

✻ In-The-Money (ITM) Put Option

☘ Intrinsic Value

☘ Time Value (Extrinsic Value)

☘ (Spot Price)<(Put Option Strick Price)

✺ ATM Put Option Moderate Risk Balance Immediate Profit

✻ At-The-Money (ATM) Put Option

☘ Time Value (Extrinsic Value)

☘ Spot Price≅Put Option Strick Price

✺ OTM Put Option High Risk Profit on Volatility & Strategy

✻ Out-of-The-Money (OTM) Put Option

☘ Time Value (Extrinsic Value)

☘ (Spot Price)>(Put Option Strick Price)

Technical Strategy

✭ Bullish✺ Buy Call

✺ Sell Put

✺ Bull Call Spread

✺ Bull Put Spread

✭ Bearish

✺ Buy Put

✺ Sell Call

✺ Buy Put

✺ Bear Put Spread

✺ Bear Call Spread

✭ Neutral

✺ Short Strangle

✺ Short Straddle

✺ Iron Butterfly

✺ Iron Condor

Greeks

✭ Delta✭ Gamma

✭ Theta

✭ Vega

✭ Rho

Simulation

✭ Least Squares Monte Carlo✭ Conditional Monte Carlo

Option Trading Strategy

✭ Income Strategy✺

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

✺

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

✺

| Strategies | Long Call |

|---|---|

| Component | Buy call |

| Potential Profit | When the stock price/index level is above the break-even point |

| Potential Profit | Unlimited, equals to the prevailing stock price/index level minus break-even point |

| Maximum Loss | Total premium paid |

| Time Value Impact | Negative |

| Break-even | Strike price/level plus premium paid |

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

| Strategies | Short Put |

|---|---|

| Component | Sell Put |

| Potential Profit | When the stock price/index level is above the break-even point |

| Potential Profit | Limited to the premium received |

| Maximum Loss | Substantial, equals to break-even point minus stock price/index level |

| Time Value Impact | Positive |

| Break-even | Strike price/level minus premium received |

✺

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

✺

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

✺

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

✺

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

✺

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

✺

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

✺

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

✺

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

✺

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

| Strategies | |

|---|---|

| Component | |

| Potential Profit | |

| Potential Profit | |

| Maximum Loss | |

| Time Value Impact | |

| Break-even |

Algo Trading Strategy

✭ Delta Neutral Nifty✭ Equity Derivatives Algo Trading Strategy

✭ Equity Risk Derivatives Algo Trading Strategy

✭ Warant Derivatives Algo Trading Strategy

✭ Bond Derivatives Algo Trading Strategy

✭ Basis Derivatives Algo Trading Strategy

✭ Zero Coupon Derivatives Algo Trading Strategy

✭ Interest Rate Derivatives Algo Trading Strategy

✭ Interest Rate Cap & Floor Derivatives Algo Trading Strategy

✭ Deferred Rate Derivatives Algo Trading Strategy

✭ Total Return Derivatives Algo Trading Strategy

✭ Credit default Derivatives Algo Trading Strategy

✭ Constant Maturity Derivatives Algo Trading Strategy

✭ Subordinated Risk Derivatives Algo Trading Strategy

✭ Variance Risk Derivatives Algo Trading Strategy

✭ Accreting Derivatives Algo Trading Strategy

✭ Three-Zone Digital Derivatives Algo Trading Strategy

✭ Currency Derivatives Algo Trading Strategy

✭ Quanto Derivatives Algo Trading Strategy

✭ Range Accrual Derivatives Algo Trading Strategy

✭ Amortizing Derivatives Algo Trading Strategy

✭ Commodity Derivatives Algo Trading Strategy

✭ Inflation Derivatives Algo Trading Strategy

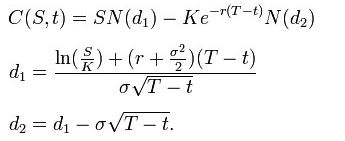

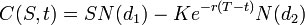

Option Pricing Formula

✭ Black Scholes Option Pricing Formula✺ Call Option Pricing Formula

✺ Put Option Pricing Formula

✺ Put Option Pricing Formula

For both, as above N is the cumulative distribution function of the standard normal distribution T – t is the time to maturity S is the spot price of the underlying asset K is the strike price r is the risk free rate (annual rate, expressed in terms of continuous compounding) σ is the volatility in the log-returns of the underlying

Option Data

✭ Option Chain✺ Call Option Chain

✺ Put Option Chain

✭ Heatmap

✺ Option Heatmap

✭ OI Stastics

✺ Cumulative OI

✺ Cumulative OI Change

✺ Individual OI

✺ Individual OI Change

✭ Trending OI

✺ Trending OI Sentiment

✺ Trending OI

✺ Individual OI

✭ PCR Ratio

✺ PCR Ratio Data

✺ PCR Ratio Chart

✭ Option Analysis Chart

✺ Call OI Analysis Chart

✺ Put OI Analysis Chart

✺ Call Vs Put OI Analysis Chart

✺ Combined Premium Chart

✺ Payoff Chart

✺ Multi Strike OI Chart

Futures Data

✭ Heatmap✺ Future Heatmap

Risk Analysis

✭ Market Volatility✺ India VIX Volatility Index

✺ CBOE VIX Volatility Index

✭ Interest Rate Hike Risk

✺ Repo Rate

✺ Reverse Repo Rate

✺ EBLR

✺ MIBOR

✺ MIBOR

Risk Strategy

✭ Hedging✺ Back-to-Back Hedge

✺ Tracker Hedge

✺ Delta Hedge

✺ Risk Reversal Hedge

Market Data

✭ SMC Data✺ SMC OTC Derivative Daily Analysis Research Reports

Research Analytics

☰ Trading AnalyticsSubscribe OTC Derivatives Research

✭ Derivatives Trading

✺ OTC Derivatives Trading

✻

♣ Stock Options

♣ Stock Forwards

♣ Stock Forwards REPO

♣ Stock Swaps

♣ Equity Risk Swaps

♣ Warant Options

♣ Bond Options

♣ Bond Forwards

♣ Bond Forwards REPO

♣ Bond Forwards Swaps

♣ Basis Swaps

♣ Zero Coupon Swaps

♣ Interest Rate Forwards

♣ Interest Rate Forwards REPO

♣ Interest Rate Swaps

♣ Interest Rate Cap & Floor Options

♣ Deferred Rate Swaps

♣ Total Return Swaps

♣ Credit Forwards

♣ Credit Forwards REPO

♣ Credit default Swaps

♣ Constant Maturity Options

♣ Constant Maturity Swaps

♣ Subordinated Risk Swaps

♣ Variance Risk Swaps

♣ Accreting Swaps

♣ Three-Zone Digital Swaps

♣ Currency Options

♣ Currency Forwards

♣ Currency Forwards REPO

♣ Currency Swaps

♣ Quanto Swaps

♣ Range Accrual Swaps

♣ Amortizing Swaps

♣ Commodity Forwards

♣ Commodity Forwards REPO

♣ Commodity Swaps

♣ Inflation Swaps

☰ Trading Hours

| OTC Derivatives | Carry Forward Trading | Regular-Market Session | 12:00 a.m to 11.59 p.m | Over-the-Counter |

|---|---|---|---|---|

| OTC Derivatives | Intra-day Trading | Regular-Market Session | 12:00 a.m to 11.59 p.m | Over-the-Counter |

| OTC Derivatives | Auto Square-off Time | Market Closing Session | 23:59 PM | Over-the-Counter |

☰ OTC Derivatives Features

| Instrument | Exchange | Contract Size | Contract Cycle | Expiry Date | Settelment |

|---|---|---|---|---|---|

| Stock | Over-the-Counter | Negotiated Term | Negotiated Term | Agreed Term | Cash Settled/Underlying Assets Transfered |

Sign-up Trading Account to trade OTC Derivatives on Over-the-Counter.

Open Trading Account

☰ Funding Method

✭ UPI

✭ Net Banking

☰ OTC Derivatives Option Trading Charges

| Brokerage (Standard Plan) | Rs. 20/- FLAT per Executed Order |

|---|---|

| Brokerage (Smart Plan) | Rs. 0/- FLAT per Executed Order |

| Securities Transaction Tax (STT) | 0.01250% on Sell order |

| Transaction Turnover Charges | OTC 0.00200% |

| SEBI Fee | 0.00010% |

| GST | 18% on [ Brokerage + TC + SEBI Fee] |

| Stamp Duty | 0.002% [Only on Buy order] |

| Clearing Charges | 0.0004% |

| Brokerage (Standard Plan) | Rs. 20/- FLAT per Executed Order |

|---|---|

| Brokerage (Smart Plan) | Rs. 0/- FLAT per Executed Order |

| Securities Transaction Tax (STT) | 0.01250% on Sell order |

| Transaction Turnover Charges | OTC 0.00200% |

| SEBI Fee | 0.00010% |

| GST | 18% on [ Brokerage + TC + SEBI Fee] |

| Stamp Duty | 0.003% [Only on Buy order] |

| Clearing Charges | 0.01% |

☰ OTC Derivatives Forward REPO Trading Charges

| Brokerage (Standard Plan) | Rs. 20/- FLAT per Executed Order |

|---|---|

| Brokerage (Smart Plan) | Rs. 0/- FLAT per Executed Order |

| Securities Transaction Tax (STT) | 0.01250% on Sell order |

| Transaction Turnover Charges | OTC 0.00200% |

| SEBI Fee | 0.00010% |

| Stamp Duty | 0.00010% [Only on Buy order] |

| Clearing Charges | 0.0004% |

| Brokerage (Standard Plan) | Rs. 20/- FLAT per Executed Order |

|---|---|

| Brokerage (Smart Plan) | Rs. 0/- FLAT per Executed Order |

| Securities Transaction Tax (STT) | 0.01250% on Sell order | Transaction Turnover Charges | OTC 0.00200% |

| SEBI Fee | 0.00010% |

| Stamp Duty | 0.00010% [Only on Buy order] |

| Clearing Charges | 0.001% |

Our Team

A team of Dynamic and Talented Professionals and a diverse team comprising engineers, tech geeks, market experts, finance experts, and a dedicated support team to deliver a better and enhanced trading experience hitherto undreamt of.

Customer

SHINDE Stock Brokers HNI customers are Promotors, Directors, Partners, Proprietors & HUF across India. SHINDE Stock Brokers retail customers are resident individuals across India and non-resident individuals all over world.

Regulator

Depository

Cleaning and Settlement

Over-the-Counter

SHINDE Stock Brokers is a business partner Stock Broker AP for SEBI registered Stock Broker | MONEYWISE FINVEST LIMITED | SEBI REGN No. INZ000196835 | Member: NSE: EQ, FO, CDS, COM, DEBT 90161 | BSE: EQ, FO, CDS, COM, DEBT 6690 | MCX: COM 56325. SHINDE Stock Brokers is a business partner for SEBI registered Research Analyst | SMC GLOBAL SECURITIES LIMITED | SEBI REGN No. INH100001849.

Investments in securities market are subject to market risks. Read all the related documents carefully before investing. Refer the Risk Disclosure Document issued by SEBI. Insurance is a subject matter of solicitation.

KYC: SHINDE Stock Brokers follow Know Your Customer (KYC) Guidelines - Anti-Money Laundering Standards for all financial transactions under the Prevention of Money Laundering Act, 2002 and insist customer to submit officially valid documents as proof of name and address. The officially valid documents means PAN card number and Aadhaar Card number or GST nummber. For more detail send mail at tushar@shinde.org or call us on telephone no. 9320690034.

Tushar Shinde is the founder, promoter and CEO of SHINDE Stock Brokers.

Contact us

✆ 9321690034

✆ 9320690034

✆ 9820690034

✉ tushar@shinde.org

www.shinde.org

Tushar Shinde

CEO

SHINDE Stock Brokers

Marketing Office :

B/402, Lotus Corporate Park

Laxmi Nagar, Goregaon (E)

Mumbai - 400063

Maharashtra

India

Registered Address :

202, Rachana Apartment, Anand Nagar

Kulgaon, Badlapur (E)

Thane - 421503

Maharashtra

India

Join Telegram Channel SHINDE

Follow Instagram Channel TUSHAR SHINDE